EXM CRYPTOCURRENCY FUND

WHY ECF

Since Inception in 2016, our ECF seeks to preserve capital while also achieving capital appreciation for institutional and individual investors. the objective of the fund is pursued at varying levels of targeted capital appreciation and preservation , depending on class and strategy , through the implementation of multiple investment strategies. These strategies relate to investments in tokenized securities, tokenized assets, certain cryptocurrencies (Such as Bitcoin, Ethereum,masternodes,and other Future altcoins). Securities tokens, utility tokens,"mining", tethers and other digital or crypto assets

Strategies

The Fund is divided into 3 deliverable Strategies (3 part series)

Class T ( Trading ) : Class T actively trades assets seeking to maximize capital appreciation with a secondary emphasis on capital appreciation (Aggressive approach). Class T is denominated in ( USD)

Class B ( Bitcoin ) : Class B seeks to maximize capital preservation with a secondary emphasis on capital appreciation ( Conservative approach). Class is denominated in Bitcoin ( BTC). Class B is an active strategy for long term holders of Bitcoin.

Class E ( Ethereum) : Class E seeks to balance capital appreciation and capital preservation. Class E is denominated in Ethereum (ETH) with performance measured in ETH. Class E is an attractive strategy for those with a cache of Ethereum.

Control

* The Account Owner retains sole ownership

* The Account owner maintains control of withdrawing

* The beneficiary can be changed to another member of the same family without income tax consequences

* The Fund offers flexible payment and withdrawal options.

Execution and Pricing Transparency

The ECF expects to acess liquidity across premier exchanges and OTC counterparties

Compliance with best execution policies ; the ECF obtains more favorable excution pricing

Operational Ease

The Asset Management team includes experts with over 66 years of combined experience in the fund and asset management sector

The fund has strict concentration, strategy allocation, and liquidity rules limiting maximum exposure.

Proper Risk Management

Part of the sucess of EXM Capital is our global trading risk management capability, dealing with high volumes of sophisticated multi-asset retail flow, benefiting from a significant proportion of natural aggregation. our strong capital and liquidity balances allow us to retain an element of net client portfolio risk, transferring the remaining risk through hedging to our external counterparties. The board through it's risk committee, is ultimately responsible for the implementation of an appropriate risk strategy which has been achieved by the establishment of an integrated risk management framework. the main areas covered by the risk management framework are ;

* Identification, evaluation and monitoring of the principle risk to which the company is exposed

* Setting the risk appetite of the board in order to achieve it's Strategic objectives

* Establishment and maintenance of governance, Policies, systems and controls to ensure the company is operating within the stated risk appetite

* The board has Put in place a governance structure which is appropriate for the operations of an online financial services. the structure is regularly reviewed and monitored and any chnages are subjected to board approval

ECF Fund Objectives

The Fund seeks to provide capital growth, current income, and preservation of capital through a portfolio of asset class performance in cryptocurrency

Via the Fund, investors gain diversified exposure to this Dynamic Asset Class performance by the way if the funds unique investment approach.

The Fund offers the most diverse and holistic approach in Cryptocurrency investing.

How Can Cryptocurrency Protect Portfolios ?

There are two risks to consider

Short Term Deflation Long Term Inflation

Portfolios need hard assets to protect against long-term inflation , and Bitcoin because of its programmatic scarcity is a hard asset

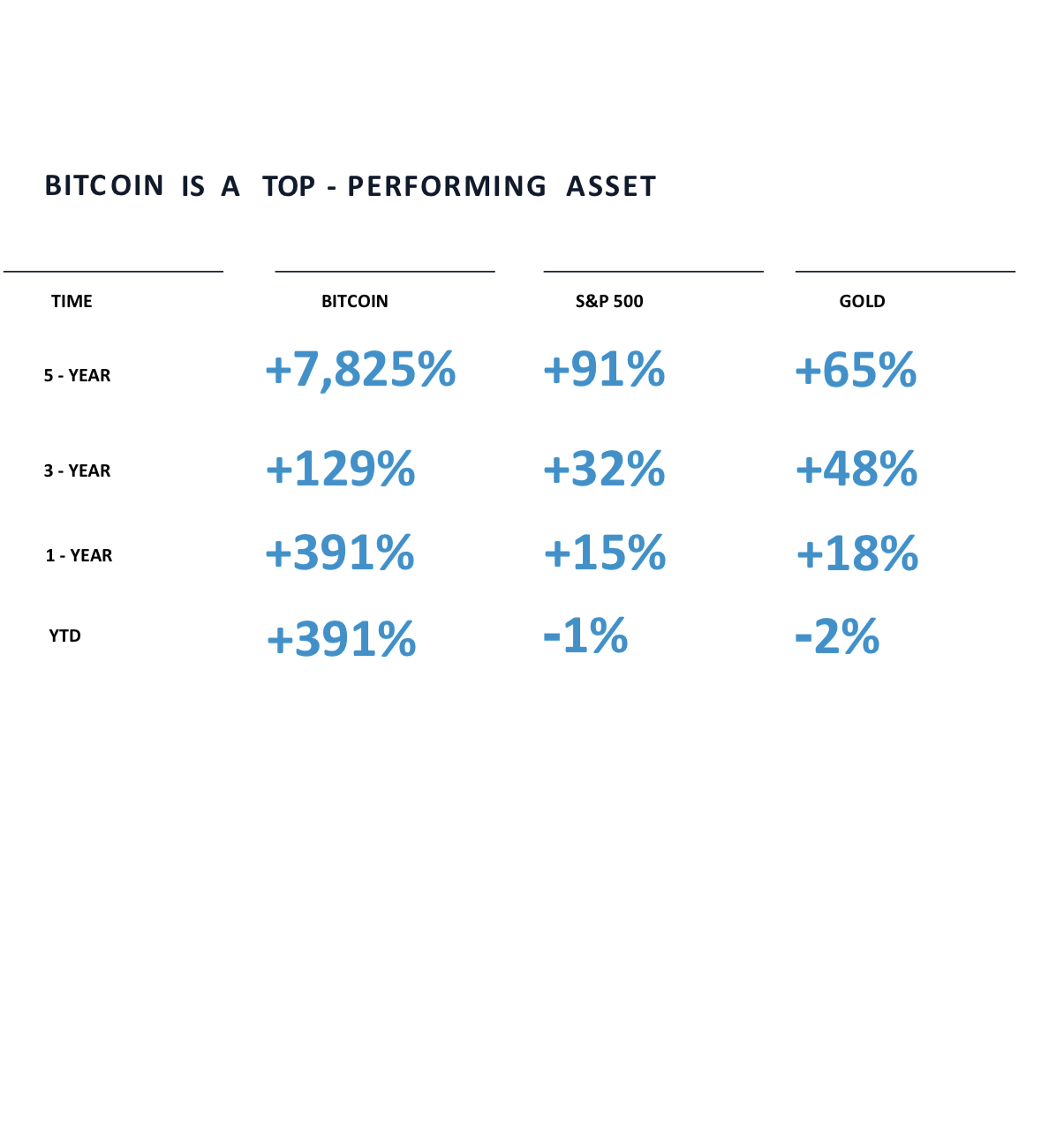

Why Invest ?

Compelling Hedge

Cryptocurrencies such as Bitcoin are compleling Hedge to the current macro uncertainty surrounding trade wars and the heightened levels of expansionary monetary policy.

THE WORLD IS DIGITIZING MORE RAPIDLY

IN A POST-COVID WORLD, INCREASED COMFORT AND FAMILIARITY WITH DIGITAL WALLETS AND SOLUTIONS WILL ONLY FURTHER SUPPORT BITCOIN’S ADOPTION

DIGITAL MONEY

• Central Bank Digital Currencies (CBDCs) are gaining traction across the globe, led by China’s digital

renminbi and Sweden’s e-krona

• A recent survey among 66 central banks by the Bank for International Settlements shows that more than 80% are working on CBDCs

• A draft of the CARES Act called for the creation of digital wallets and accounts for US citizens and businesses to efficiently send stimulus checks

• Stablecoin issuance has exceeded $20 billion

PAYMENTS

• The revamped Libra project will bring a digital payments system using stablecoins / currency-pegged coins to Facebook’s 2.5 billion users

• Starbucks is working with NYSE / ICE through its Bakkt platform to test launch a consumer app for digital asset payments

• JPMorgan created JPM Coin to facilitate efficient cross-border payments

• Paypal have adopted bitcoin as a means of payment solution

STORES OF VALUE

• Square’s Cash App bitcoin volume exceeded $300 million in 1Q20, nearly double the previous quarter’s volume

• The OCC ruled that financial institutions may custody digital assets on behalf of their clients

• NYSE / ICE-backed Bakkt launched the first federally regulated bitcoin exchange, as well as physically settled futures and options contracts

• PayPal and Venmo to roll out direct purchases of digital assets

BITCOIN IN A PORTFOLIO

BITCOIN’S VALUE PROPOSITION: AN INFLATION HEDGE AND A GROWTH ASSET

OUR VIEW IS THAT BITCOIN’S, VALUE IS DERIVED FROM ITS UNIQUE INELASTIC SUPPLY SCHEDULE, NON-SOVERIGN STATUS, IMMUTABILITY, AND NETWORK SECURITY

LIMITED SUPPLY

• Bitcoin offers one of the only verifiably scarce, immutable, and capped supply assets in the world

• Only 21 million bitcoin will ever be issued

NON-SOVEREIGN STATUS

• No single point of failure or control

• Supply issuance resistant to macro or government influence

• Democratized digital money

IMMUTABILITY

• Hard-coded software designs user rules

• All transactions between users are permanently recorded

• Auditable transaction verification and history

SECURITY

• Cryptographically secured and validated transactions

• Security lies in the asymmetry of the costs of performing the “proof-of- work”

• The Bitcoin blockchain has never been hacked