THE DEFI OPPORTUNITY

The news around decentralized finance (DeFi) is impossible to ignore. While it is difficult to imagine the future of finance without the traditional financial intermediaries we rely upon today, the emerging area of DeFi has the potential to upend the entire financial ecosystem as we know it.

DeFi refers to the set of apps that offer financial services without a central financial intermediary. This alternative to traditional financial services replicates financial functions such as borrowing, lending, and exchanging assets without relying on financial intermediaries such as brokerages, exchanges, or banks. The magnitude of potential presented by this blockchain-powered global movement is revolutionary and may disintermediate the current financial industry.

The financial industry currently occupies an average of 8% of total GDP annually and has for over two decades. Even as we witnessed GDP jump from $12.7T in 2005 to $22.7T in 2021, the percentage held remained constant for this industry.

The stability of this hold on GDP exemplifies the traditional finance industry’s power that DeFi challenges. We are continually assured of the future of this movement by the incredible pace of DeFi’s growth and its market cap of $90B. DeFi is the first genuine attempt to disrupt the massive centralized financial sector

Introduction

What is Defi ?

DeFi is short for “decentralized finance,” an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries.

DeFi draws inspiration from blockchain the technology behind the digital currency bitcoin, which allows several entities to hold a copy of a history of transactions, meaning it isn’t controlled by a single, central source. That’s important because centralized systems and human gatekeepers can limit the speed and sophistication of transactions while offering users less direct control over their money. DeFi is distinct because it expands the use of blockchain from simple value transfer to more complex financial use cases.

Bitcoin and many other digital-native assets stand out from legacy digital payment methods, such as those run by Visa and PayPal, in that they remove all middlemen from transactions. When you pay with a credit card for coffee at a cafe, a financial institution sits between you and the business, with control over the transaction, retaining the authority to stop or pause it and record it in its private ledger. With bitcoin, those institutions are cut out of the picture.

Direct purchases aren’t the only type of transaction or contract overseen by big companies; financial applications such as loans, insurance, crowdfunding, derivatives, betting and more are also in their control. Cutting out middlemen from all kinds of transactions is one of the primary advantages of DeFi.

Before it was commonly known as decentralized finance, the idea of DeFi was often called “open finance.”

DEFI ?

DeFi is a system of digital financial apps that replicate and innovate various functions that we rely on intermediaries to perform today including asset management, crypto lending, and derivative exchanges. DeFi is developing across different blockchain networks but operates primarily on the Ethereum blockchain. The Ethereum blockchain launched in 2015 as a technology that built on bitcoin’s innovation, with some key differences. Both the Bitcoin and the Ethereum blockchains allow users to transact with digital value without payment providers or banks. But Ethereum’s general programmability goes far beyond the Bitcoin blockchain’s simple balance transfers. Ethereum is the world’s first programmable blockchain, which is to say all value is programmable. “Smart contracts” implement if/then logic into assets themselves; they are like computer programs running on the blockchain that can execute automatically when certain conditions are met. Ethereum introduces this into every asset, and in doing so, it significantly expands the world’s choices for interacting with money.

One of the unique features of DeFi is that all of these projects can use and leverage each other, a trait commonly

referred to as “composability.” This level of permissionless interoperability is significant to the continued growth of the entire space. That said, all of this interoperability is enabled because these projects build on Ethereum. Composability is currently only possible between projects that operate within the same blockchain ecosystem, such as Ethereum, and becomes increasingly difficult when trying to communicate between two different blockchains. While other blockchains are bringing forward DeFi applications, the DeFi ecosystem originally developed on Ethereum. Thus, DeFi is still mostly confined to Ethereum.

These advancements in blockchain technology empower

DeFi developers to recreate the architecture of legacy financial systems with the code-based digital infrastructure of DeFi apps. We see DeFi offering global, inclusive financial service improvements with incomparable enhancements

in speed, cost, and accessibility, opening up entirely new possibilities for economies and individuals worldwide.

THE DUALITY OF DEFI

We should not consider DeFi as some kind of challenger taking on the white knights of traditional finance. Instead, think of DeFi as an ecosystem that can live independently of traditional finance and integrate with traditional finance. The traditional payment system in the U.S. and broader financial systems currently operate based on a paper currency- driven world, and that’s why many elements of them feel antiquated. We see a future where more traditional economic activity transitions to using blockchain as its rails. For example, it should no longer take three days to withdraw money from digital payment services like Venmo. Moving to blockchain will enable these exchanges and withdrawals to be nearly instantaneous. We fully expect the amount of financial activity that happens on blockchain to increase thanks to DeFi.

We also expect that you will soon see fintech apps integrating directly into DeFi. It is not far-fetched to imagine someone depositing money into Chime to earn a yield via Compound, and their idle balance on Robinhood starts earning yield from Aave. One current example is Centrifuge, an app that tokenizes real-world assets and allows issuers to borrow against collateral, creating an obligation that is tradeable on-chain. The obligation has legal recourse in the event of default. This type of activity is just one clear example of traditional finance and DeFi integrating.

These are the early innings of on-chain investment vehicles. DeFi opens new possibilities for diversification of indexes with both on- and off-chain assets, intersecting the two systems. Other potential DeFi app functions we expect to materialize leverage traditional finance data to make better decisions on-chain. Imagine using off-chain credit scores and bank data to help an underwriter extend credit to a borrower on-chain. We see endless possibilities and enhancements to traditional finance afforded by DeFi and blockchain technology.

THE RISE OF DEFI

We see, in real-time, just how useful Ethereum technology is as we watch the rise of decentralized finance (DeFi)

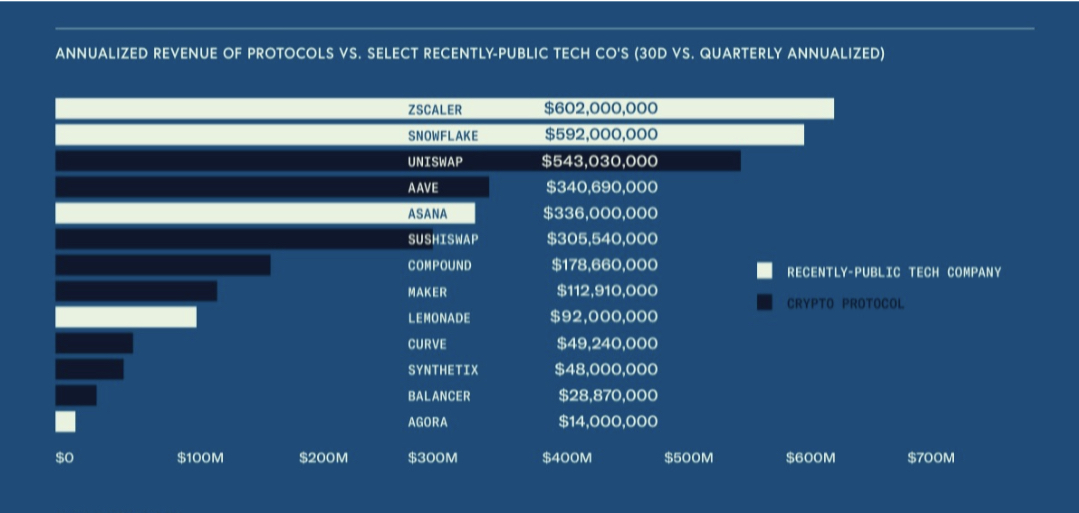

and non-fungible tokens (NFTs). Ethereum now hosts seventeen DeFi applications valued at more than $1B, including Compound, Uniswap, and Aave. These protocols are quietly producing hundreds of millions in annualized revenue. DeFi has experienced exponential growth in the first half of 2021 that we anticipate will continue.

The growth facilitated by the Ethereum blockchain is seen by the number of innovative apps and platforms we now have facilitating asset management, crypto lending, decentralized exchanges, and derivative exchanges.

What makes these specifically designed blockchain apps unique is that most of them are fully programmable, permissionless, and composable.

Several key DeFi players have set the stage for the current DeFi ecosystem by contributing significant innovations. The DeFi space moves quickly, but gaining an understanding of these innovators is a great place to start. The first notable DeFi platform is MakerDAO. This project introduced

the first decentralized stablecoin called DAI. Maker was

the first Peer-to-Contract network to gain traction, but Compound took things a step further.

Compound is a money market protocol that allows users

to deposit crypto assets into smart contracts that pool assets and earn a yield while being borrowed. Compound was unique because suppliers/lenders were consistently earning a variable yield so long as there was at least a single borrower. This provided a step-function improvement in DeFi lending as borrowers and lenders no longer needed to be matched on a one-off basis (i.e., a peer-to-peer lending market or an order book).

THE ROLE OF DEFI IN THE MODERN PORTFOLIO

DeFi can be viewed as a collection of high-growth individual stock picks. And while it may be challenging to know which apps will emerge victoriously because these are such early days for the asset class, we view the entirety of DeFi as a growth asset. The ethos of Decentralized Finance has far-reaching and revolutionary implications. DeFi is actively innovating to rebuild the current financial infrastructure in a way that is not only faster and more cost-efficient but also fully transparent.

DeFi is actively innovating to rebuild the current financial infrastructure in a way that is not only faster and more cost-efficient but also fully transparent. This is a future

where transaction settlement is not only instant but openly verifiable and one in which counterparty risk no longer exists. This is the future of finance.

Defi MarketCap

Defi Total Revenue as of June 2021

The Total Value locked (TVL) in Decentralized Finance As of August

2021 is worth $90 Billion

MARKET GROWTH

Market for Defi Projects is expected to grow at the highest rate between 2020 and 2024. The Ethereum blockchain focuses on running the programming code of any decentralized application, including Distributed Applications(DApps)and smart contracts, enabling it to be built and run without any downtime, fraud, control, or interference from a third party. The advantages offered by Ethereum over bitcoin, such as electronic cash, smart contract technology, and proof-of-stake, are expected to drive the growth of the market for Defi Projects in the next few years.

EXM Defi Private Placement

Focus

The EXM Defi private Placement provides targeted Exposure to one of the most exciting use-cases of The crypto industry.

Decentralized Finance has the power to disrupt Segments of the financial industry that are worth Trillion of dollars

Methodology

The EXM Defi private Placement provides investors With solutions for gaining exposure to the most important Defi Projects. A robust Methodology Can increase the chances of owning the industry Winners over the long term.

Security

Assets are held with second-to-none institutional Grade custody execution platforms. EXM Defi Private placement continuously evaluates security Developments to stay up-to-date on industry best Practices continuously .