EXM OTC Arbitrage Trade Program

Description

Every 2 years EXM Capital in partnership with institutional firms offer discreet trading of securities to private investors, accredited investors and a relatively small number of high networking individuals.

This trade deal is executed discreetly without the knowledge and exposure of the market, and as such not manipulated or affected by the global market’s conditions. It’s returns are fully controlled by EXM Capital and the other institutional firm’s involved.

Understanding the rules of the road

None of the customary standards and practices that apply to normal, conventional business, investing and finance applies to private funding programs. It is a "privilege" to be invited to participate in a OTC Trade Transaction Program, not a "right." The trading administrators and managers have a virtually endless supply of financially qualified applicants.

An applicant should never underestimate what the trading entities knowledge about him. Failure to provide full disclosure will disqualify the disingenuous. Clients must first prove that they are qualified, not the other way around.

Only the principal owner of funds is required as signatory. Corporations must empower an Officer or Director as sole, exclusive signatory by using a Corporate Resolution. Not only do the funds have to be on deposit in an acceptable Teir 1 Settlement house; they must also be in an acceptable jurisdiction. It is felony fraud to submit documents or financial instruments that are forged, altered or counterfeit. Such documents are promptly referred to the appropriate law enforcement agencies for immediate criminal prosecution. The practices, procedures and rules are determined by the U.S. Federal Regulatory Authorities, Western European Central Banks program management, licensed traders and trading banks. It is their decision whom to accept and whom to reject. Contract terms, yield, schedules, etc., are made to fit their needs and schedules – and not the caprices or demands of the investors. This marketplace is highly regulated and strictly confidential, and absolute confidentiality by the investor is a key element of every contract. A client who breaks confidentiality will precipitate instant cancellation. Finally, submission of the application documents to more than one management group at a time is termed "shopping". If an investor "shops" he can expect that this fact shall be quickly disseminated and known among the program management groups who maintain close communication – and will then be accepted by none and rejected by all.

Understanding the rules of the road – For the Investor

Investor affirms that any funds or assets placed are done so at their own specific initiative, risk, and authorization with full consideration and without duress. Investor further affirm that the information received is intended solely for my PRIVATE & CONFIDENTIAL USE ONLY. They are sophisticated investors by all definitions of that classification known to them; They make their own investment decisions, and have legally acquired assets available. Investor hereby reaffirm, under penalty of perjury that they have requested information from you and your organization and that you have not solicited me in any manner.

Investor understand that the contemplated transaction is strictly one of Private Placement and is in no way relying upon existing regulations in relation to the FCA and the United States Securities Act of 1933 as amended, or related regulations, and does not involve the buy and sell of securities. Investor must further declare that they are not a licensed securities broker or government employee and understand that neither are you or your organization

Advantages to the Investor

- This trade deal allows investors to trade without exposure until after the trade has been executed. This guarantees returns because it is an arbitrage deal done discreetly without the knowledge of the market

- EXM Capital has full control of the outcome of the deal from returns to purchase of securities

EXM'S Role in this OTC Arbitrage Trade Program

For this Private OTC Arbitrage Trade Program The Firm serves as the Investment facilitator by providing an investment-friendly legal and business climate.

- Advocacy within government to seek necessary approvals or urge the removal of obstacles to investment

- Targeting or investment generation by actively seeking out investors based on OTC development plans or other criteria.

EXM Capital serves as a Core Liquidity Provider for OTC transactions serving as a middleman in the securities or forex market. The Firm buy large volume of securities from the companies that issue them and distribute them in batches to financial institutions that then make them available directly to retail investors. The Firm simultaneously buy and sell shares of a security with the goal of ensuring that they are always available on demand

OTC Arbitrage Trade Details

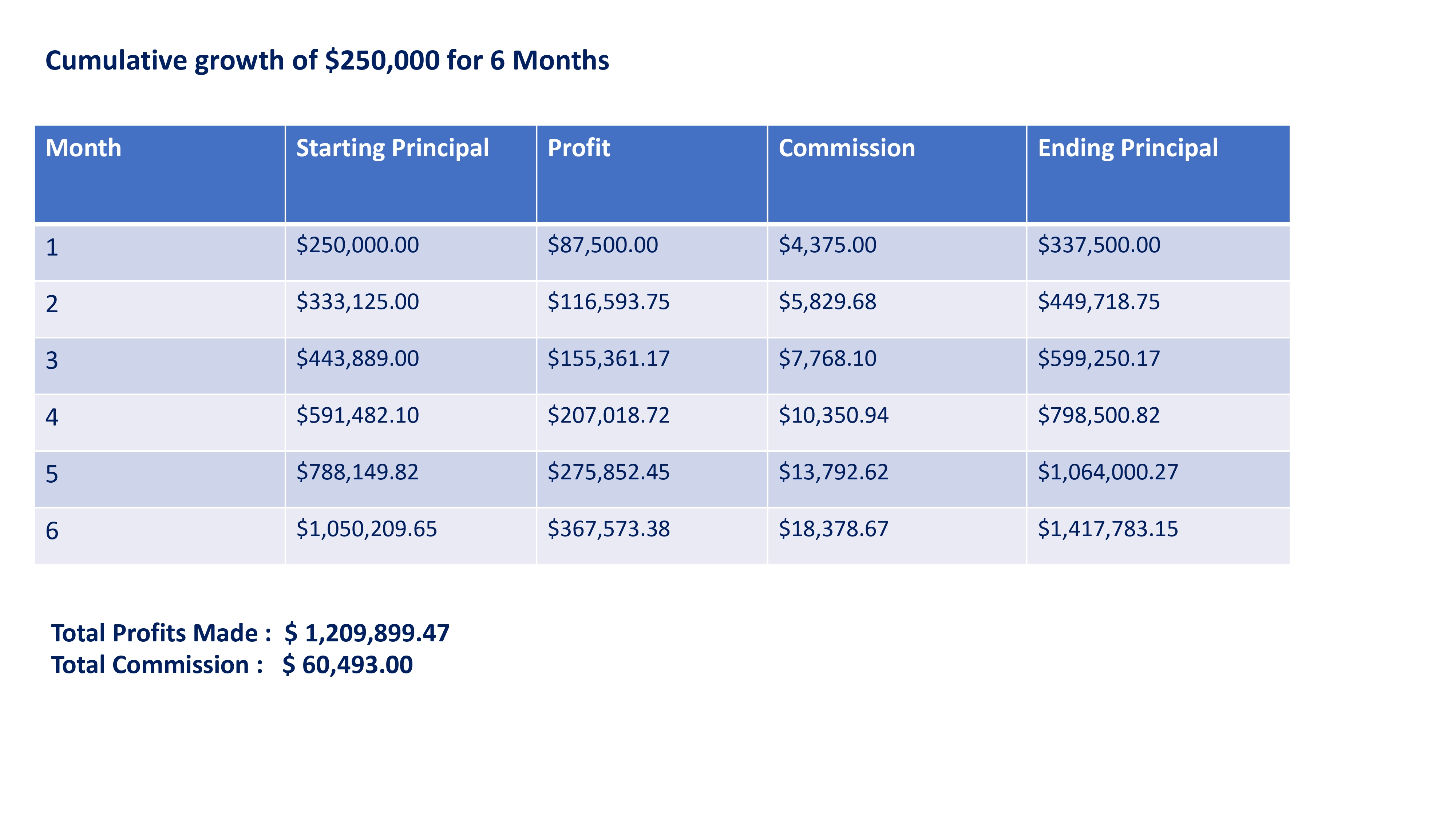

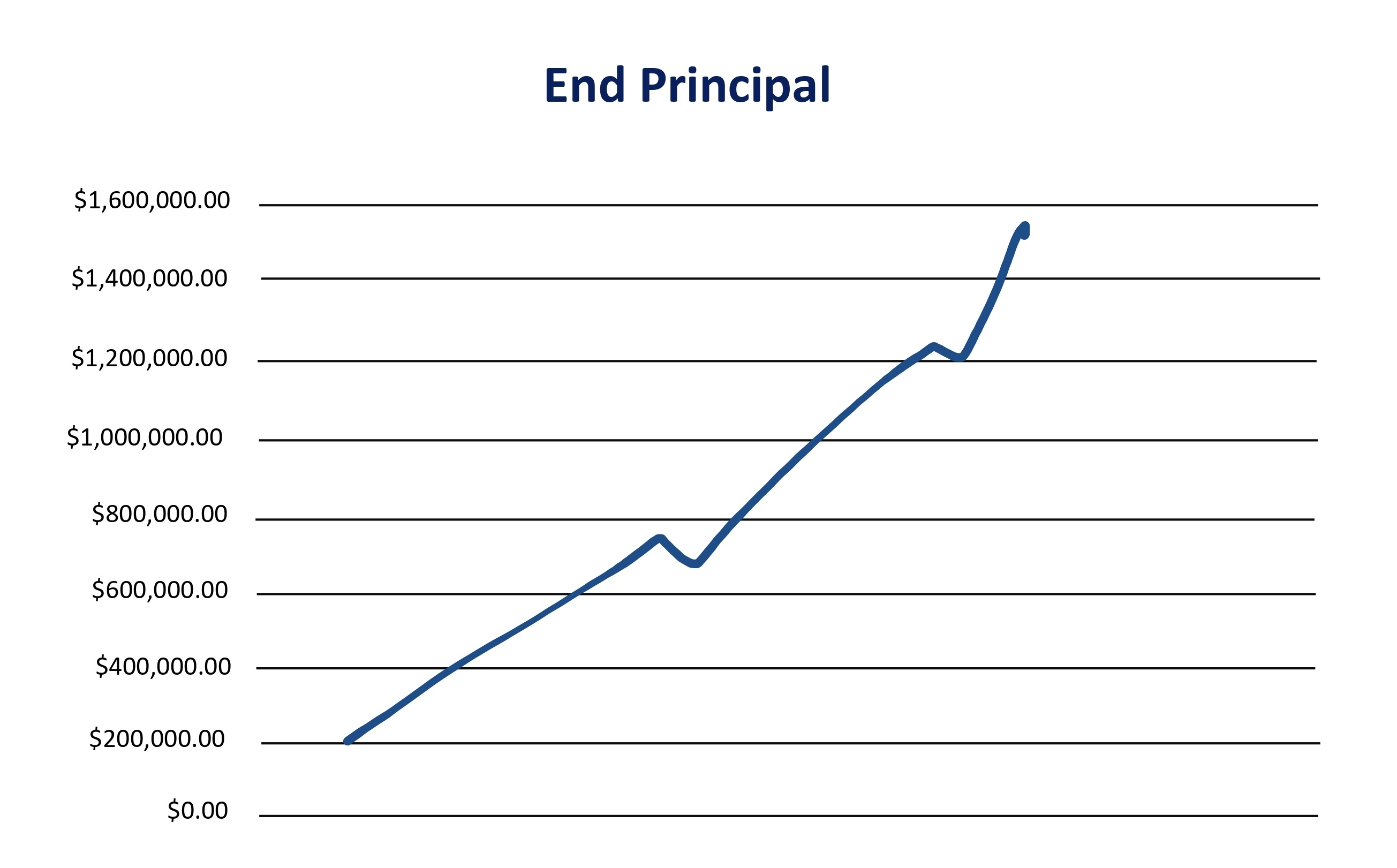

- Minimum Investment : $250,000

- 6 Months Program

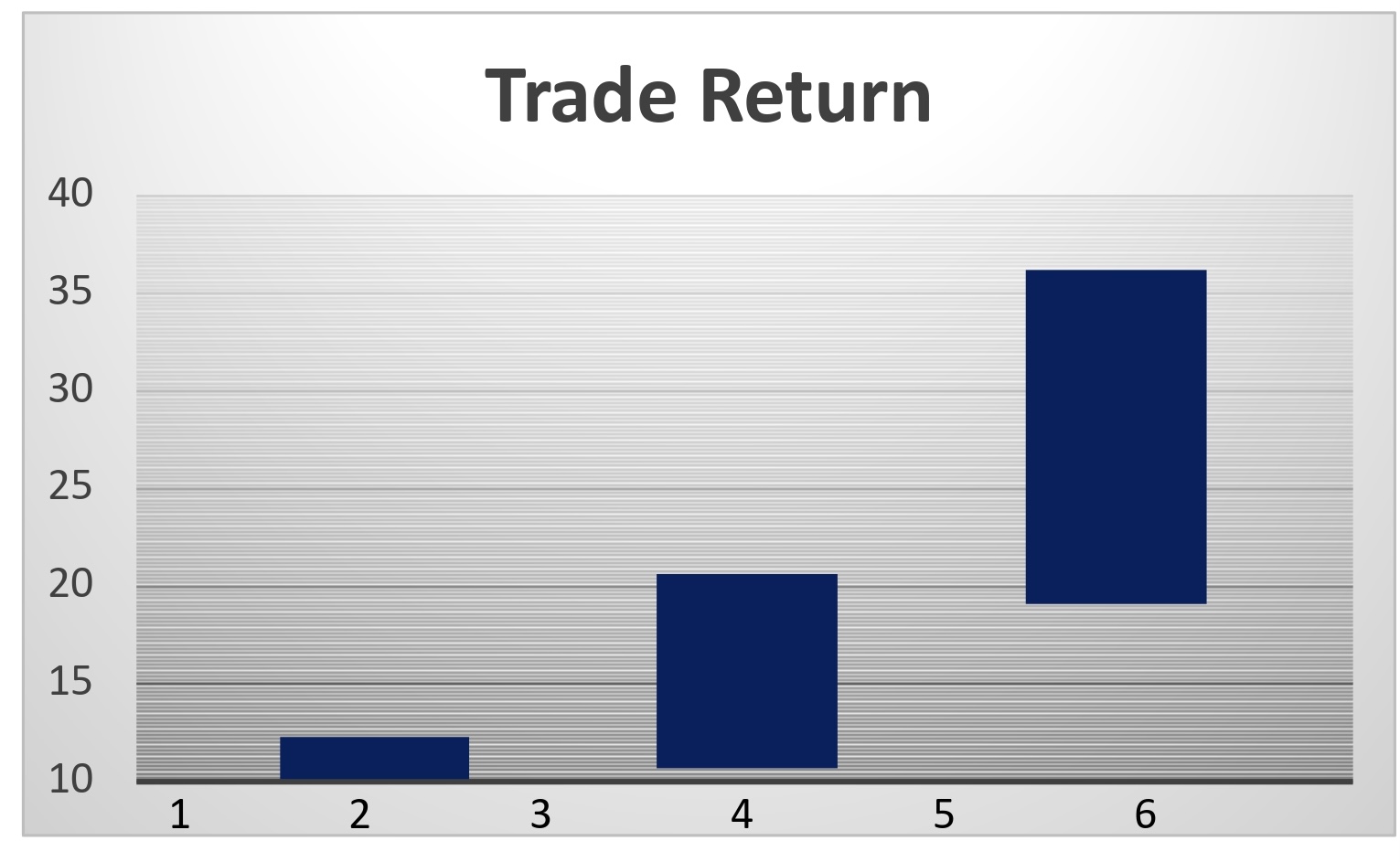

- 35% ROI Monthly